Personalized engagement program

Through proactive communications, we engage, educate, and encourage your workforce to achieve better financial outcomes.

Year one onboarding

A series of emails highlighting plan features and resources to help new participants get off to a good start saving

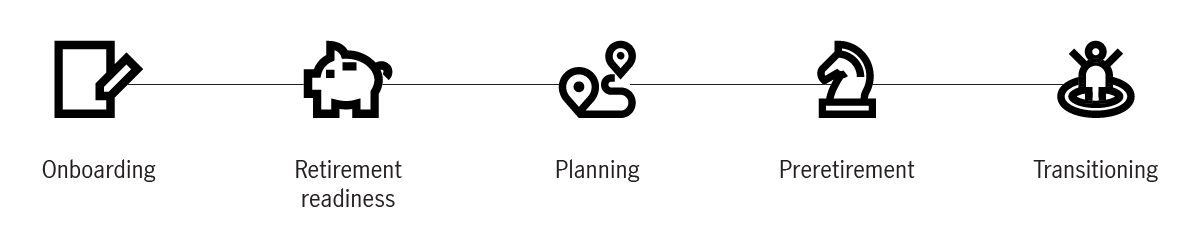

Journey-based outreach3

Emails tailored to each generation with suggested actions based on the progress they’re making on their goals

Achieving retirement balance

Personalized nudges for people age 50 and older to help them make a smooth transition from saving to retirement income

Quarterly newsletter

Personalized financial wellness support based on age, plan status, available plan features, and digital behaviors

Live and on-demand webinars

Workshops hosted by our retirement specialists to help participants plan for tomorrow while meeting their current needs

Making an impact

Our 2025 targeted outreach to nonparticipants inspired 1,300 individuals to enroll, with an average contribution rate of 7.6%4

Year one onboarding

Explore how we connect with new participants, encouraging them to make the most of your retirement plan.

Registering their account

Getting personalized retirement advice7

Naming beneficiaries

Driving better outcomes

63% of newly enrolled participants who received these communications engaged with our onboarding program.8

Wealthy and healthy in 2026

Boosting your well-being today for better tomorrows

January

1/27/26-2/13/26

Quarterly newsletter

March

3/10/26-3/20/26

Journey-based outreach3

Check back during the quarter for samples

Simplify and organize

Spring clean your finances for easier money management

April

4/28/26-5/15/26

Quarterly newsletter

Check back during the quarter for sample

June

6/9/26-6/19/26

Journey-based outreach3

Check back during the quarter for samples

Reflect and recharge

Hot tips and cool ideas to help participants save

July

7/28/26-8/14/26

Quarterly newsletter

Check back during the quarter for sample

September

9/8/26-9/18/26

Journey-based outreach3

Check back during the quarter for sample

Protect and prepare your finances

Simple steps to help participants secure their financial future

October

10/27/26–11/13/26

Quarterly newsletter

Check back during the quarter for sample

December

Holiday Break

Additional journey-based outreach to encourage proactive planning

Campaign-specific resources

Materials for you to share with participants to support our quarterly initiatives

Digital library

Ready-to-go resources covering common financial wellness and retirement topics

Viewpoints

Timely and informative articles to help participants plan and save for retirement

Learn more about how we help participants confidently save and invest for their retirement goals.

1 “2024 Wealth Management Industry Awards, the Wealthies,” best 401(k) service in the retirement plan support and advisor services category, 2024. 2 Actions to consider based on plan design and participant need. 3 Messaging is tailored to participants based on age (generation), plan status (active or terminated with account balance), and other factors. Not all participants will receive all messages. 4 Internal Manulife John Hancock data as of 9/30/25. 5 As other options are available, participants are encouraged to review whether consolidating accounts, staying in a retirement plan, rolling over into an IRA, or another option is best, as there are advantages and disadvantages to each. 6 The projected retirement income estimates for your current Manulife John Hancock accounts, future contributions, employer contributions (if applicable), and other accounts set aside for retirement used in this calculator are hypothetical, for illustrative purposes only, and do not constitute investment advice. Results are not guaranteed and do not represent the current or future performance of any specific account or investment. Due to market fluctuations and other factors, it is possible that investment objectives may not be met. Investing involves risks, and past performance does not guarantee future results. 7 Subject to plan availability. Participation in John Hancock Personalized Retirement Advice (Retirement Advice) does not guarantee investment success. Investing involves risks, including the potential loss of principal. Fees for this service are based on a tiered schedule and vary by account balance. For more information, consult the Retirement Advice investment advisory agreement. John Hancock Personal Financial Services, LLC (JHPFS), an SEC registered investment adviser and affiliate of John Hancock Retirement Plan Services LLC (JHRPS), is the investment manager of the Retirement Advice program. JHPFS has selected Morningstar Investment Management LLC, a registered investment adviser and wholly owned subsidiary of Morningstar, Inc., to act as the independent financial expert (as defined in the U.S. Department of Labor’s Advisory Opinion 2001-09A) for Retirement Advice. JHPFS monitors Morningstar Investment Management’s performance. Morningstar Investment Management LLC is not affiliated with JHRPS, JHPFS, or affiliates. JHPFS acts as a fiduciary with respect to the management of Retirement Advice investments. 8 John Hancock internal data as of 9/20/24. Of the 491,705 total participants onboarded since program inception in 2021, 310,406 opened/clicked on the communications.

Important disclosures

Important disclosures

John Hancock Personal Financial Services, LLC is an SEC registered investment adviser. John Hancock Personal Financial Services, LLC, 200 Berkeley Street, Boston, MA 02116.

MGR1218255074133