Baby boomer retirement planning—how employers can help ease the transition

Retirement looks much different today than it did for the grandparents of your employees—not only in terms of lifestyle but also duration. In 1950, with an average life expectancy of 68, retirees only needed their savings to last a few years. Now, they can expect to live until 79, demanding smarter, longer-lasting financial strategies.¹ As an employer, you have an opportunity to help baby boomers manage longevity risk by offering retirement planning tailored specifically to their needs.

The case for baby boomer retirement planning

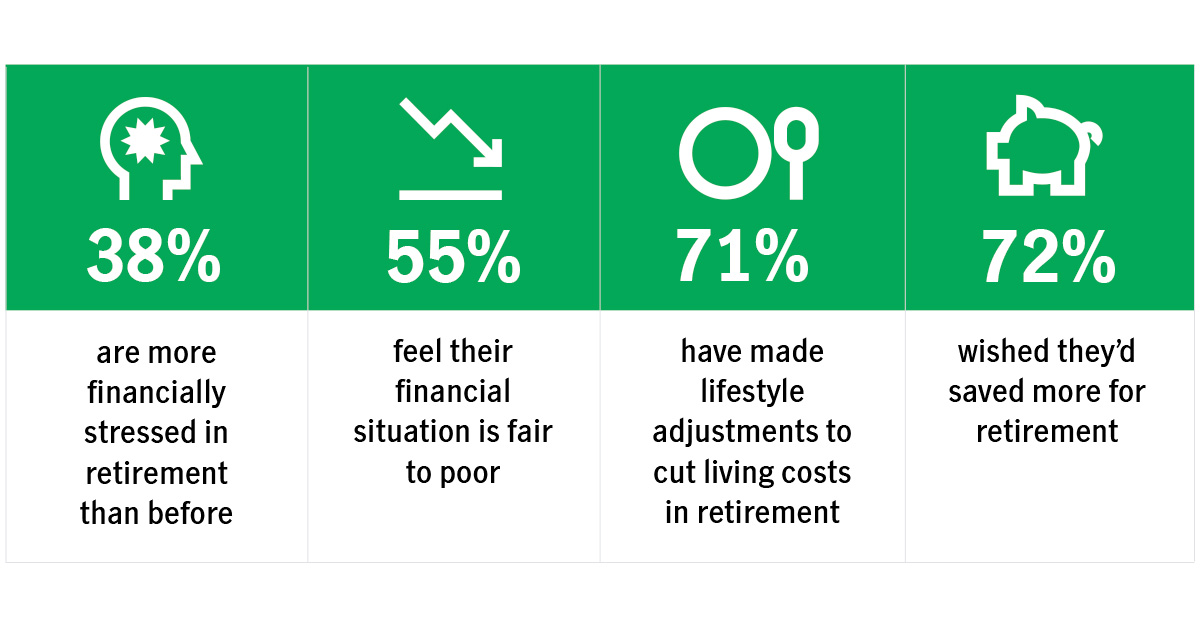

More than half of baby boomers (55%) expect to delay retirement to increase their retirement savings.2 But this may not be the best or most realistic strategy. Our 10th annual survey of American workers found that 62% of retirees stopped working sooner than they planned.2 And many are struggling financially, highlighting the importance of proactive planning and the stress of having to stretch savings longer than expected.

The experience of early retirees2

There’s another compelling reason to help baby boomers plan for their future. While older workers bring a wealth of skills and institutional knowledge to your organization, delayed retirements can increase your compensation, benefits, and talent acquisition costs—especially if younger workers leave due to limited advancement opportunities. Offering retirement planning can help baby boomers feel more prepared, leading some to reconsider their retirement age, potentially benefiting your bottom line.

Developing your strategy

Let’s look at three areas where baby boomers could use some support and how you can help with each one.

1 Longevity planning

Baby boomers face the exciting challenge of planning for a retirement that could last decades. Not surprisingly, 85% expect to rely on their 401(k) or 403(b) accounts to help fund these years.2 And they need help figuring out how to make their savings last. That’s where longevity planning comes in. It’s a relatively new concept in retirement planning that’s gaining traction as our society grapples with the issues of an aging population.

What does this support generally entail?

Online planning tools that provide guidance and actions to help your participants: |

|

Education meetings focused on breaking down the complexities of preparing for retirement, including: |

|

Be sure to consult with your plan’s financial professional and recordkeeper to find out what longevity-related resources they offer. Their assistance can streamline the process, helping you launch your retirement planning program quickly and efficiently.

2 Building financial resilience in retirement

Of all the generations, baby boomers are experiencing the lowest level of financial stress, and they’re the most optimistic about their retirement savings.2 Even so, nearly a third are worried about affording necessities, such as food and housing, in retirement. Over half are also concerned about rising healthcare costs, which may contribute to their fear of running out of money.2 Consider hosting a series of meetings to help these workers strengthen their financial resilience—something that’s essential for their future well-being.

Topics to consider include:

- Creating a retirement budget

- Balancing saving with paying off debt

- Tips for maximizing savings

- Understanding the basics of Medicare

- Building emergency savings

- Strategies for making their investment portfolio retirement ready

Once again, your plan’s financial professional and recordkeeper may offer presentations that you can use, so be sure to discuss your baby boomer education strategy with them. By fostering financial resilience, you can help older workers feel less anxious that they’ll have enough money to fund a decades-long retirement.

3 Retirement transition strategies

The final area of support involves examining your plan design and organizational policies. What are you looking for? Opportunities to help your older workers retire on their terms and make the most of their retirement savings.

Here are a few questions to consider during your review:

- Does your plan permit catch-up contributions?

- How flexible are your plan’s withdrawal options?

- Do you offer preretirement counseling?

- Is phased retirement a possibility? Part-time work? Job sharing?

- Do your employee benefits support the needs of an aging workforce?

- What changes can be made to create a more supportive work environment?

Before making any decisions, it’s important to understand the possible impact on both your business and your workforce. Consider forming a committee with representatives from your legal, finance, operations, and HR teams to help you evaluate the potential benefits and drawbacks of each opportunity you identify.

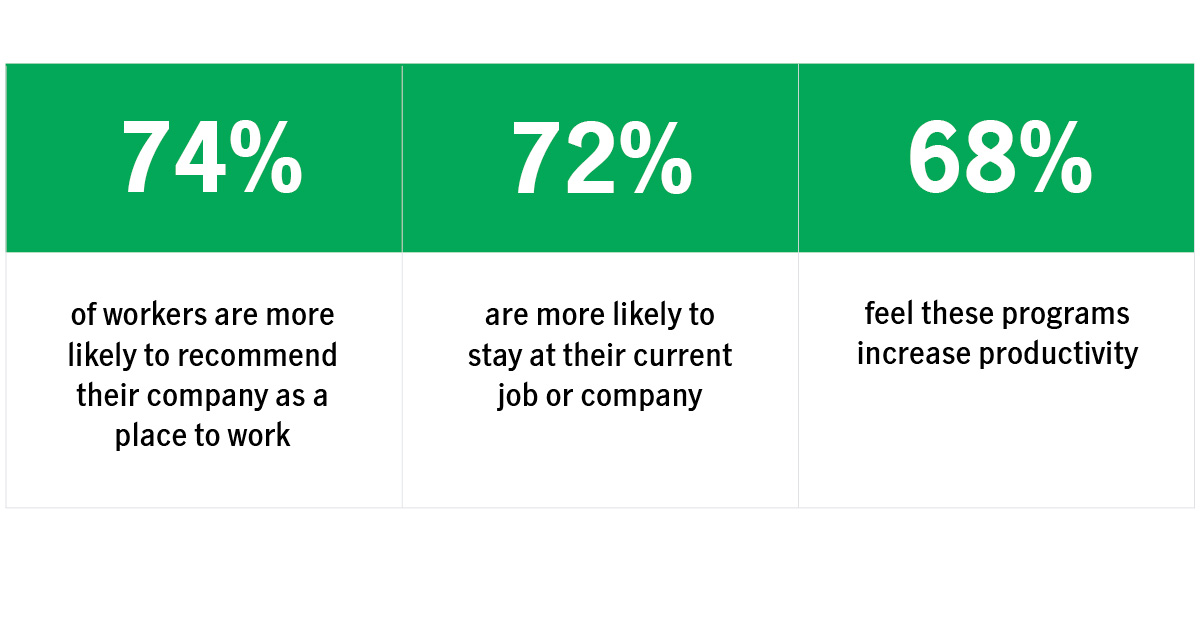

Ripple effects on your business

Baby boomers aren’t the only ones who may benefit from your support. Providing comprehensive retirement planning can show your entire workforce that you care about their well-being, which can help:

- Build loyalty and goodwill

- Boost morale

- Increase productivity

- Attract and retain talent

The positive impact of financial wellness programs2

Help ease the transition from work to retirement

As baby boomers prepare to retire, many are eager to explore new passions, just like the 48% of retirees already doing so.2 To enjoy these adventures, they need to feel financially prepared for a retirement that could span decades.

Consider offering longevity-focused retirement planning to help them build this confidence and embrace life after work. For more insight, view our full 2024 financial resilience and longevity report.

1 Macrotrends.net, July 2024. 2 2024 John Hancock financial resilience and longevity report, a commissioned study.

How can we make a longer retirement better?

Longevity is about balancing health and wealth to help make those extra years better. The implications are shifting the way we think about retirement.

Important disclosures

Important disclosures

In June 2024, John Hancock commissioned our 10th annual financial resilience and longevity survey with the respected research firm Edelman Public Relations Worldwide Canada (Edelman). An online survey of 2,623 John Hancock plan participants was conducted between 5/17/24 and 6/3/24 and 525 retired Americans, sourced through Angus Reid’s research panel, was conducted between 5/13/24 and 5/28/24. The objectives of the study were to learn more about individual stress levels, their causes and effects, strategies for relief, and to provide custom insight around how retirees are faring in retirement. John Hancock and Edelman are not affiliated, and neither is responsible for the liabilities of the other.

This content is for general information only and is believed to be accurate and reliable as of the posting date, but may be subject to change. It is not intended to provide investment, tax, plan design, or legal advice (unless otherwise indicated). Please consult your own independent advisor as to any investment, tax, or legal statements made.

MGR0214254228646